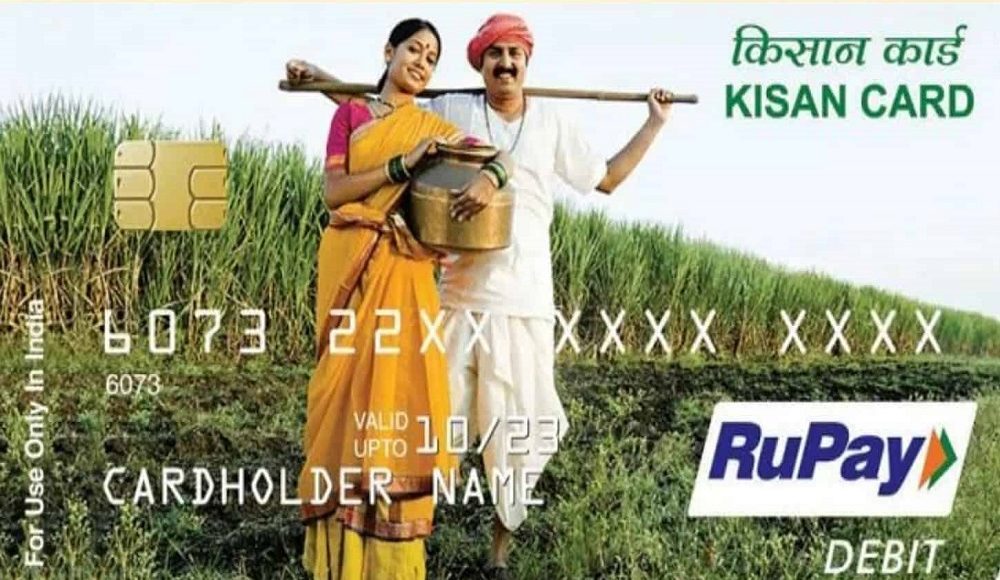

Kisan Credit Card kya hai, How to Online apply for KCC?

How to apply for KCC

Bharat ek krishi pradhan desh hai, jaha Kisan ko sabse jyada Importance di jati hai. kya ap jante hai, ki Kisan credit card (KCC) scheme ke Under apko 1 lakh rupaye ka Loan bina kisi Security ke mil sakta hai.yadi apke pas bhi Kisan credit card (KCC) hai to ap bhi 1 lakh rupaye ka Loan le sakte hai.

Indian government ne is scheme ko Start kiya hai. kisan ko fasal jotane se lekar use Market me behne tak kai tarah ki jarurate lagti hai. unhe har jagah financial help ki jarurat hoti thi. Kisan credit card (KCC) scheme se pahle Kisan apni in jarurato ko pura karne ke liye jamidaro evm informal sectors par Dependent rahte the.

In sectors se Loan lene ki sabse badi Problem ye thi ki inki Interest rates bahut jyada hua karte the. Sath hi jab jarurat hoti thi tab hame kai bar Loan milta bhi nahi tha. Kisano ki is Problem ko dekhte huye Indian government ne August 1998 me Kisan Credit Card (KCC) Scheme Start kit hi.

Aaj ham apko batayenge Kisan Credit Card kya hai? Kisan Credit Card par Loan kaise milta hai? Kisan Credit Card par kitna Loan milta hai? Kisan Credit Card lene ke liye Document kya kya lagte hai ? aaj apko in sabhi Questions ke answer apko mil jayenge.

Kisan Credit Card kya hai? (What is a Kisan Credit Card)

Bank our dusri financial institutions me Long and difficult process hone ke karan kai bar Kisano ko Loan mil nahi pata tha. Kisano ko Loan nahi mil pane ka main Region hi iski difficult process thi. Kisan Credit Card (KKC) ko Start isi liya kiya gaya ki Kisano ki Problem ka solution ho sake. Kisan Credit Card (KCC) ko Start isliye kiya gaya tha kyo ki krishi me ka ane vala saman jaise Bij. Kitnashak,urvark jaise kai chijo ko kisan kharid sake, our kheti me hone vale kharche ka paisa vah nikal sake.

2004 me kisano ne is skim me farming related and non-farming kam me Investment ke liye Loan requirement ko pura karne ke liye age badaya tha. 2014 me ek bar fir se is skim ko Facility ke anusar banane ke liye banko ne apne Customers ko Electronic Kisan Credit Card Provided karana Start kiya tha.

Kisan Credit Card (KCC) ka Uddeshy Kya hai? (What is the purpose of Kisan Credit Card/KCC)

Kisan Credit Card (KCC) ka main Uddeshy sahi samay par Banking system se Kisano ko financial help mil sake.jisase vah Easy tarike se kheti our apni dusri jarurato ko pura kar sake. Kisan Credit Card (KCC) me apko jo Loan milta hai, usase ap apni in jarurato ko pura kar sakte hai.

– Fasal katai ke bad ka kharch.

– Fasal bechne me aye kharcho ko pura karna

– Kisano ke ghar ka kharch.

– Krishi our krishi se Related kam ko karne ke liye our kheti ki kharidari karne ke liye.

– Krishi our krishi se Related kam me Investment ke liye.

Kisan Credit Card Scheme me Kisano ko unko Loan requirement ko samay par pura karna our Loan related sabhi karyo ko karna. Incidental expenses ke alava Ancillary activities related expenses ki purti karna hi Kisan Credit Card Scheme ka main Uddeshy hai.

Kisan Credit Card (KCC) ke liye Documents kya hai? (Documents for Kisan Credit)

Reserve Bank of India ke According Loan bank par Dependent rahta hai. yah bank par Depend rahta hai ki vah Kiasan se Kisan Credit Card ke liye kon se Documents mangta hai, our kon se nahi. Isliye sabhi banko ki alag- alag document requirement ho sakti hai.

Kisan Credit Card ke liye Basic document (Basic Document for Kisan Credit Card)

– Kisan dvara Fill kiya gaya our Sign kiya hua application form.

Identity Card :-

– Aadhar Card

– Voter ID

– Driving License etc ki Copy.

Address proof :-

– Aadhar card

– Passport

– Electricity

– water bill etc.

Photograph :-

– Latest Passport Size Photograph

papers :-

– Land or business papers

Yadi ap 1 lakh rupye ka Loan lete hai, to apse bank Security nahi mangte hai.

Kisan Credit Card se Loan kon le sakta hai? (loan from Kisan Credit Card)

Kisan Credit Card se Loan lene ke liye apki Age Minimum18 years our maximum 75 years ho sakti hai. yadi kisi 60 years ke vykti ko Loan chahiye to, unhe 60 years se kam Age vale vykti ka Co-borrower hona jaruri hai. Kisan Credit Card se Loan ye vyakti le sakte hai.

– Kisan akele ya Joint loan le sakte hai, jiske pas khud ki juamin hai.

– Kirayedar Kisan, maukhik pattedaar our hisse me kheti karne vale Kisan.

– Kisan Self Help Group ya Joint Liability Groups me bhi loan le sakte hai.

Kisan Credit Card par Loan kaise le?

Kisan Credit Card (KCC) scheme me Loan lena kafi simple Process hai.ap Kisan Credit Card Loan ke liye online and offline Apply kar sakte hai. offline Apply karne ke liye apko bank Branch me ja kar application de sakte hai. ap dono hi tariko se Kisan Credit Card Loan ke liye easily Apply kar sakte hai.

Kisan Credit Card ke liye online Apply kaise kare? (How to online apply for Kisan Credit Card)

Kisan Credit Card par kai bank Loan dete hai. ese kai Kisan hai jinke pas Kisan Credit Card nahi hai. kai bank Kisan Credit Card ke liye online application lete hai. yadi ap bhi apna Kisan Credit Card banvana chahte hai, to apko kuchh easily Steps follow karne honge.

– Kisan Credit Card banvane ke liye sabse pahle apko bank ki Website par jana hoga.

– Bank ki Website par par di gai cards List me se apko Kisan Credit Card Option Select karna hoga.

– Ab Kisan Credit Card par Apply button par Click kare.

– Ab apke samne Kisan Credit Card (KCC) online application page open ho jayega.

– Kisan Credit Card Form ko sahi se fill kar Submit par Click kare.

– Jab apne Form fill karte samay E-mail our Mobile number diya tha, us par apko Application Reference Number send kar diya jayega.

– Application Reference Number apko bank me Kisan Credit Card lene ke samay bahut kam ata hai.

– Bank apki eligibility Check karne ke bad 3-4 day bad apki Kisan Credit Card Application par process start hai.

– Ab apke pas bank se call ata hai. bank apko age ki Steps karne ke liye kahta hai. sath hi apko Application process karne ke liye Important documents information deta hai. Document collect karne ke liye appointment liya jata hai. bank puri tarah se verification karne ke bad our puri formality Complete karne ke bad bank me apka Kisan Credit Card Loan account open ho jata hai.

Kisan Credit Card ke liye Offline Apply kaise kare? (How to Offline apply for Kisan Credit Card)

Kisan Credit Card (KCC) ke liye Offline Apply karne ke liye apko apne bank ki Branch me jana hoga. apko apne bank ki Branch me Kisan Credit Card application form ko Fill kar Important documents ke sath bank me deposit karana hoga. bank apni taraf se puri inspection karne ke bad apka Lone pass kar deta hai.

Kisan Credit Card par kitna Lone milta hai?

Kisan Credit Card ke Under milne vale Lone ki koi Limit Fix nahi ki hui hai. ye bank par Depend karta hai, ki vah apko Kisan Credit Card (KCC) ke Under kitna Lone dene vali hai. kuchh bank to Kisan Credit Card ke Under Crore me Lone diya jata hai.

Kisan Credit Card loan limit krishi se hone vali aapki Income par our non-farming activities, total land owned, our ugai gai fasal ke adhar par kiya jata hai.yadi apko 1 lakh se jyada ka Lone chahiye to apko bank ke pas apni Jamin ya fasal Girvi rakhni hogi.

Kisan Credit Card par Interest rates kitna hota hai? (Interest rates on Kisan Credit Card)

Kisan Credit Card par Interest rates Lone dene vali bank Decide karti hai. Kisan Credit Card par apko 2 tariko se Lone milta hai. short term and long term. Kisan Credit Card par par milne vale Lone ki Interest rates is bat par bhi Depend karti hai, ki ap kon sa Lone lene vale hai.

Main banks Kisan Credit Card par is tarah Interest rates leti hai.

Bank Short Term Loan Long Term Loan

Axis Bank 8.85% – 13.10% 8.85% – 14.10%

PNB (Punjab National Bank)* 7% Base Rate + 2%

State Bank of India 7% – 13.30% 11.30% – 16.55%

Bank of Baroda 7% – 10.9% 11.65% se Start

Yadi ap sahi samay par apne Loan ka payment karte rahte hai, to apko kuchh bank Interest par 2% to 3% discount bhi de sakti hai. hamare dvara batai gai Interest rates me bank kabhi bhi Change kar sakti hai.

Kya Kisan Credit Card Bima milta hai? (Kisan Credit Card insurance)

Kisan Credit Card par Bima mil sakta hai. Loan lene vale applicant par Depend karta hai, ki vah Bima (Insurance) lena chahta hai, ki

Kisan Credit Card par kitna Bima cover milta hai? (Insurance cover on Kisan Credit Card)

Kisan Credit Card par apko 50 thousand ka life insurance cover ke sath 25 thousand ka Accident cover milta hai. insurance premium bank decide karti hai.

Kisan Credit Card ke liye qualification kitni jaruri hai? (minimum qualification of Kisan Credit Card)

Kisan Credit Card ke liye qualification jaruri nahi hai. Kisan Credit Card skim ka labh koi bhi Kisan le sakta hai.

Kisan Credit Card ke labh (Benefits of Kisan Credit Card)

Indian government chahti hai, ki Kisan Samman Nidhi Scheme ke tahat sabhi ko Kisan Credit Card diye jaye, taki Kisan ko easily bank se Loan mil sake. Kisan Credit Card par interest rate 9 percent hai, lekin 2 percent subsidy mila kar 7 percent interest rate pad jata hai. yadi ap samay par Loan chukka dete hai, to apko 3 percent our discount mil jata hai. is tarah Kisan ko Kisan Credit Card par interest rate sirf 4 percent hi dena hota hai.

Pashupalan and matsya palan me Kisan Credit Card

Government ne Pashupalan and matsya palan Sectors me bhi Kisan Credit Card scheme ke dayre me la diya hai. ab har koi Kisan Credit Card scheme la kabh le raha hai. har koi bank me Kisan Credit Card ke liye Applications de raha hai.

Kisan Credit Card ki Special bate (Important Thinks of Kisan Credit Card)

– Yadi apke pas kheti ki jamin hai, to ap ise bina Girvi rakhe Loan le sakte hai. pahle isli Limit 1 lakh rupees thi, lekin ab RBI ne without guarantee vale krishi Loan Limit 1.60 lakh rupees kar di hai.

– Pashupalan and matsya palan karne vale Kisano ko bhi Kisan Credit Card se 2 lakh rupye ka Loan 4 percent interest rate par mil sakta hai.

– Hajaro Kisano ke pas Kisan Credit Card hai.bank ke sath mil kar Government Kisan Credit Card banane ka ek campaign chala rahi hai. jisme Kisan Credit Card (KCC) ki Application Process ko easy kiya gaya hai. form Received hone ke 14 day ke andar Kisan Credit Card issuekarne ke order diye gaye hai.

Kisan Credit Card holder ki Death hone par kya kare? (Death of Kisan Credit Card Holder)

Kisan Credit Card holder ki Death hone par Kisan ke Family member bank se Contact kar Information le sakte hai. sath hi ap Toll Free Helpline Number 155261 / 1800115526, 011-23381092 par Contact kar sakte hai

Kisan Credit Card se sasta Loan (Cheap loan with Kisan Credit Card)

kai kisano ke man me ek Question ata hai ki Kisan Credit Card me sabse sasta Loan kon sa hota hai. our ham is Loan ko kaise le sakte hai. in sabhi Question ke answer apko apni bank me mil sakte hai, ya fir ap jyada jankari ke liye https://www.pmkisan.gov.in par Login kar sakte hai.

Kisan Credit Card Helpline Number pm-Kisan Helpline Number. 155261 / 1800115526 (Toll Free), 011-23381092 hai.

14 day me ban jayega apka Kisan Credit Card

Kisano ko Kisan Credit Card application dene ke 14 days bad apko apna Kisan Credit Card mil jayega. Government ke Strict instructions ke According bank khatoni, khasara ke adhar par 14 day ke andar kisan ko Kisan Credit Card available kara de.yadi is bich kisan ko apna Kisan Credit Card nahi milta hai, to vah District Magistrate, SDM, Deputy Commissioner krishi and krishi Officer se iski complaint bhi kar sakti hai.

Kisan Credit Card ke name (Name of Kisan Credit Card)

– Allahabad Bank – Kisan Credit Card

– Andhra Bank – AB Kisan Green Card

– Bank of Baroda – B Kisan Credit Card

– Bank of India – Kisan Samadhan Card

– Canara Bank – Kisan Credit Card

– Corporation Bank – Kisan Credit Card

– Dena Bank – Kisan Gold Credit Card

– Oriental Bank of Commerce – Oriental Green Card (OGC)

– Punjab National Bank – PNB krishi card

– State Bank of Hyderabad – Kisan Credit Card

– State Bank of India – Kisan Credit Card

– Syndicate Bank – Syndicate Kisan Credit Card

– Vijay Bank – Vijay Kisan Credit Card

PM Kisan Samman Nidhi Yojana में आवेदन कैसे करें, लिस्ट में नाम कैसे चेक करें?

VID :- Aadhaar Virtual ID kya hai, Virtual ID kaise Banaye?

History of insurance :- Bima Kya Hai, Insurance Ka paisa Kaise milega?

सुपर कंप्यूटर क्या है, Top 5 Super Computer in India